The Internal Revenue Service has a new form available for eligible self-employed individuals to claim sick and family leave tax credits under the Families First Coronavirus Response Act (FFCRA).

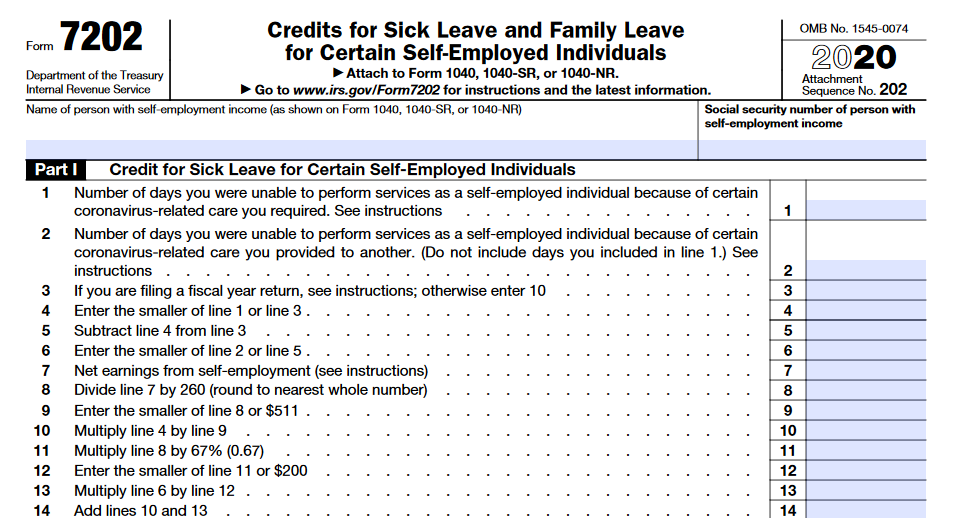

Eligible self-employed individuals will determine their qualified sick and family leave equivalent tax credits with the new IRS Form 7202, Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals. They’ll claim the tax credits on their 2020 Form 1040 for leave taken between April 1, 2020, and Dec. 31, 2020, and on their 2021 Form 1040 for leave taken between Jan. 1, 2021, and March 31, 2021.

The FFCRA, passed in March 2020, allows eligible self-employed individuals who, due to COVID-19 are unable to work or telework for reasons relating to their own health or to care for a family member to claim refundable tax credits to offset their federal income tax. The credits are equal to either their qualified sick leave or family leave equivalent amount, depending on circumstances. IRS.gov has instructions to help calculate the qualified sick leave equivalent amount and qualified family leave equivalent amount. Certain restrictions apply.

Who may file Form 7202 Eligible self-employed individuals must:

- Conduct a trade or business that qualifies as self-employment income, and

- Be eligible to receive qualified sick or family leave wages under the Emergency Paid Sick Leave Act as if the taxpayer was an employee.

Taxpayers must maintain appropriate documentation establishing their eligibility for the credits as an eligible self-employed individual.

Resources:

- Form 7202 and instructions

- Coronavirus (COVID-19) tax relief

- IRS Publication 5419, New COVID-19 Employer Tax Credits

- FFCRA related Q&As

IRS Form 7202: Printable and Fileable PDF Version

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs